LIMITED TIME: Own Futures Bootcamp for $99

THE U.S. ARMY DOESN’T TAKE THE AVERAGE ENLISTEE OFF THE STREET AND PUT THEM BEHIND A PIECE OF SOPHISTICATED EQUIPMENT

They take these gung-ho young men and women and get them prepared for service by putting them through basic training, also known as boot camp.

Because such preparation is so important, Brandon Wendell is teaching a class that will prepare the student with little or no experience to be a successful futures trader.

This “Futures Bootcamp” is a four-hour educational class that will focus on the techniques needed to successfully navigate the futures market.

For a limited time Futures Bootcamp is $99 and comes with lifetime access of the recording.

The Futures Bootcamp will be broken into four one-hour blocks of education, with a short break between each session.

THE CLASS WILL INCLUDE:

The benefits of futures over trading other assets

The different exchanges and securities available to trade

Important trading details like rollovers, price limits, regular trading

hours and extended trading hours

Risk management

How to chart futures with multiple time frame analysis

Identify the current trends

Supply and demand – the zones of selling and buying

Market correlation

There will be a heavy emphasis on trading strategies. This is not a one-size-fits all project and new traders will be taught important strategies such as trend trading, opening range breakouts, gap plays and Globex traps. You will learn how to deal with market-moving news and economic reports.

By the end of this four-hour class, you will have enough information and knowledge to trade the futures market. More importantly, you’ll be learning the right way to do it… from an instructor who has years of practical experience as a futures

PAID ACCESS TO FUTURES BOOTCAMP

Futures Bootcamp is $99

FAQS

I’ve never traded futures. Will I be lost?

Don’t worry. The Futures Bootcamp is an ideal way to learn how to make money by trading futures. The class features a series of instruction videos that begins with the fundamentals of trading futures and will walk you down the path to getting started. The four videos build on each other and were created to get you started properly.

I’m an experienced futures trader. Will this be too simple for me?

You’ll want to watch each of the four foundational videos, regardless of your level of experience. There are aspects of futures trading that you will want to review and make sure you understand completely. You may particularly enjoy the information in the latter part of the series, which more of the advanced techniques are taught and explored.

Does this class come with a manual?

Yes, the Futures Bootcamp comes with a printable manual. You can find the manual in your member’s area and print out any or all of the material that you desire. The workbook can be used with the foundational videos and give you plenty of room to take notes and embellish your education.

There are a lot of choices when it comes to trading e-minis. How can I keep them straight in my mind?

That’s correct. But Brandon Wendell has narrowed down the e-mini choices to a manageable number. The Futures Bootcamp comes with a propriety “cheat sheet” that contains names of the various candidates and all the assorted important information – the symbol, which exchange it trades on and the hours of operation, the tick value, the margin and the point value. No wonder they call it a “cheat sheet.”

I work non-conventional hours. Will I get left behind?

No, because the information is recorded, you can watch it on your own time schedule. There are no live classes to attend. Just choose the material and watch as much as you’d like. Plus, you have access to the material whenever you want and can watch it as many times as you’d like. Learn on your own schedule.

What’s the difference between trading options and trading futures?

While there are many similarities between trading options and trading futures, there are several distinctive differences. The futures market is open almost around the clock and has different terminology that is used – all of which is explained during the four-part video series that allows you to learn how to make money trading futures.

My cousin Harold said futures are dangerous and I could end up with a yard full of pork bellies?

Futures is typically safer than the regular stock market because the e-minis tend to move slower and don’t have the crazy mood swings seen in options trades. And the e-minis taught in Futures Bootcamp are cash futures, so it’s like trading money on the regular market. You’ll never get stuck with a tractor trailer full of commodities to store in your backyard!

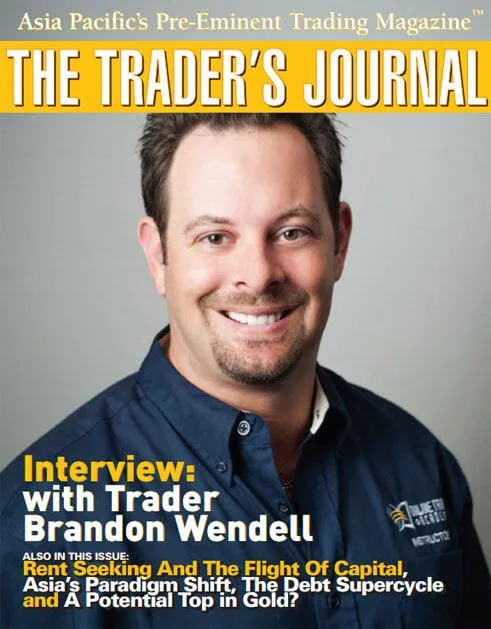

What makes Brandon Wendell qualified to teach this class?

Brandon has been a futures trader and teacher for more than 20 years. He’s worked as an individual and corporate futures trader. He holds the rare Certified Market Technician license, which is attained by very few traders because of the amount of hours and testing it requires. Brandon also hosts the E-mini Think Tank, a live weekly class that meets when the market is open and searches to find possible trading candidates.

Wealth Builders HQ - Copyright 2026 - All Rights Reserved

This site is not a part of the YouTube, Google or Facebook website; Google Inc or Facebook Inc. Additionally, This site is NOT endorsed by YouTube, Google or Facebook in any way. FACEBOOK is a trademark of FACEBOOK, Inc. YOUTUBE is a trademark of GOOGLE Inc.

If you do not agree with any term or provision of our Terms and Conditions you should not use our Site, Services, Content or Information. Please be advised that your continued use of the Site, Services, Content, or Information provided shall indicate your consent and agreement to our Terms and Conditions.

By purchasing this training series, you consent for Wealth Builders HQ and its authorized vendors to contact you at the telephone number provided for marketing purposes, with the use of technology that may include automatic dialing or prerecorded technology. Msg & Data Rates May Apply. Text back STOP at any time to opt-out. Consent is not required to make a purchase.

Neither Freedom Management Partners, Wealth Builders HQ, or any of its personnel are registered broker-dealers or investment advisers. We will mention that we consider certain securities or positions to be good candidates for the types of strategies we are discussing or illustrating. Because we consider the securities or positions appropriate to the discussion or for illustration purposes does not mean that we am telling you to trade the strategies or securities. Keep in mind that we are not providing you with recommendations or personalized advice about your trading activities. The information we are providing is not tailored to any particular individual. Any mention of a particular security is not a recommendation to buy, sell, or hold that or any other security or a suggestion that it is suitable for any specific person. Keep in mind that all trading involves a risk of loss, and this will always be the situation, regardless of whether we are discussing strategies that are intended to limit risk. Also Freedom Management Partners’ personnel are not subject to trading restrictions. We and others at Freedom Management Partners could have a position in a security or initiate a position in a security at any time.

Wealth Builders HQ may publish testimonials or descriptions of past performance but these results are NOT typical, are not indicative of future results or performance, and are not intended to be a representation, warranty or guarantee that similar results will be obtained by you. Wealth Builders HQ's coaches' experiences with trading is not typical, nor is the experience of traders featured in testimonials. They are experienced traders. Becoming an experienced trader takes hard work, dedication, and a significant amount of time. Your results may differ materially from those expressed or utilized by Warrior Trading due to a number of factors. We do not track the typical results of our past or current customers. As a provider of educational courses, we do not have access to the personal trading accounts or brokerage statements of our customers. As a result, we have no reason to believe our customers perform better or worse than traders as a whole.

Any figures and results discussed in this training are our personal results and in some cases the figures and results of previous or existing students. Please understand these results are not typical. We’re not implying you’ll duplicate them (or do anything for that matter). The average person who watches “how to” information webinars get little to no results. We’re using these references for example purposes only. Your results will vary and depend on many factors including but not limited to your background, experience, and work ethic. All business entails risk as well as massive and consistent effort and action. If you’re not willing to accept that, please DO NOT INVEST IN THIS TRAINING.

Available research data suggests that most traders are NOT profitable.

In a research paper published in 2014 titled “Do Day Traders Rationally Learn About Their Ability?”, professors from the University of California studied 3.7 billion trades from the Taiwan Stock Exchange between 1992-2006 and found that only 9.81% of day trading volume was generated by predictably profitable traders and that these predictably profitable traders constitute less than 3% of all day traders on an average day.

In a 2005 article published in the Journal of Applied Finance titled “The Profitability of Active Stock Traders” professors at the University of Oxford and the University College Dublin found that out of 1,146 brokerage accounts day trading the U.S. markets between March 8, 2000 and June 13, 2000, only 50% were profitable with an average net profit of $16,619.

In a 2003 article published in the Financial Analysts Journal titled “The Profitability of Day Traders”, professors at the University of Texas found that out of 334 brokerage accounts day trading the U.S. markets between February 1998 and October 1999, only 35% were profitable and only 14% generated profits in excess of $10,000.

The range of results in these three studies exemplify the challenge of determining a definitive success rate for day traders. At a minimum, these studies indicate at least 50% of aspiring day traders will not be profitable. This reiterates that consistently making money trading stocks is not easy. Day Trading is a high risk activity and can result in the loss of your entire investment. Any trade or investment is at your own risk.

Any and all information discussed is for educational and informational purposes only and should not be considered tax, legal or investment advice. A referral to a stock or commodity is for educational purposes only and is not an indication to buy or sell that stock or commodity.

Citations for Disclaimer

Barber, Brad & Lee, Yong-Ill & Liu, Yu-Jane & Odean, Terrance. (2014). Do Day Traders Rationally Learn About Their Ability?. SSRN Electronic Journal. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2535636

Garvey, Ryan and Murphy, Anthony, The Profitability of Active Stock Traders. Journal of Applied Finance , Vol. 15, No. 2, Fall/Winter 2005. Available at SSRN: https://ssrn.com/abstract=908615

Douglas J. Jordan & J. David Diltz (2003) The Profitability of Day Traders, Financial Analysts Journal, 59:6, 85-94, DOI: https://www.tandfonline.com/doi/abs/10.2469/faj.v59.n6.2578